Taxes Don’t Populate

-

I’m so frustrated, my customer is anxious. I’ve read the support threads and have set up the standard US tax with US-State-tax rates manually because none of the CSV files would upload. After saving and re-entering (because it disappeared 3x) the sales tax still doesn’t populate. My customer tried it and it gave .01 for tax which is wrong for CT and it’s in there at 0.0635. The boxes are right – enable automated tax – no- customer shipping – standard – excluding – excluding – n/a – as a single total. What can I do??

The page I need help with: [log in to see the link]

-

Hey @colberc,

It’s definitely important to have taxes set up correctly. I want to make sure I’m following you here. Are you saying that you’re using automated taxes and manual tax rates? If so, that’s not possible. You can use either use automated taxes or manual ones but not both.

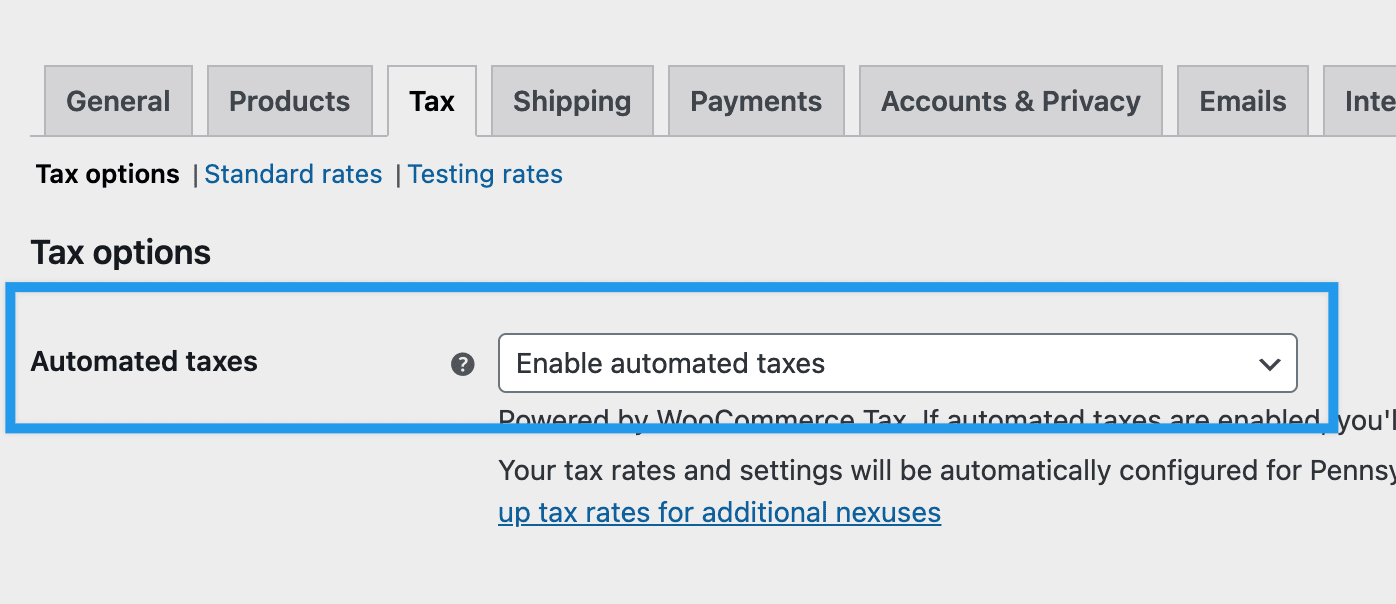

You can check and see which one is enabled by going to WooCommerce > Settings > Tax > Tax > Tax Options. Automated Taxes are enabled at the top of this page.

Let us know if you’re using automated taxes or manual taxes. Also, please take a screenshot of your tax settings in WooCommerce > Settings > Tax > Tax Options. You can upload the file to your WordPress media library and share the URL to it here or use another service to share the file.

Thanks

No, I’ve tried it both ways in teh WooCommerce>Settings>Tax>Tax Options menu. I first selected automated and it wouldn’t didn’t populate anything, no tax at all no matter what state I put the shipping address in for. This stays the same all the way to the PayPal payment or American Ex payment. Then, I switched to manual, uploaded a CSV for state taxes (wouldn’t take the CVS files from anywhere) so I manually entered to test if it would set the tax and that didn’t work. I went back to the automate taxes manually setting and all I get is .01 for tax no matter what state the order will ship to. The tax is set to bill for the customer’s shipping address. Example, when I put in an order for VA (or any state) with a billing at the cart it still says CT (where the store is based) and charges .01. The shipping area is also a problem not calculating. The time it takes to get help here is killing our sales. I really need this to resolve. Thanks for your attention to this in advance.

https://soe4u.com/wp-content/uploads/2022/05/TaxNotPopulating.jpg

https://soe4u.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-13-at-7.29.42-AM.pngThanks for sending over the screenshots. I did want to clear up one thing. Automated taxes will only collect sales tax for the business location’s state. In WooCommerce > Settings > General if the store’s location is in Connecticut, then no automated taxes will be collected outside of Connecticut. We’re not tax professionals so I can’t give advice on what to collect but where to collect sales tax is definitely something your client will want to confirm with a CPA or other tax professional.

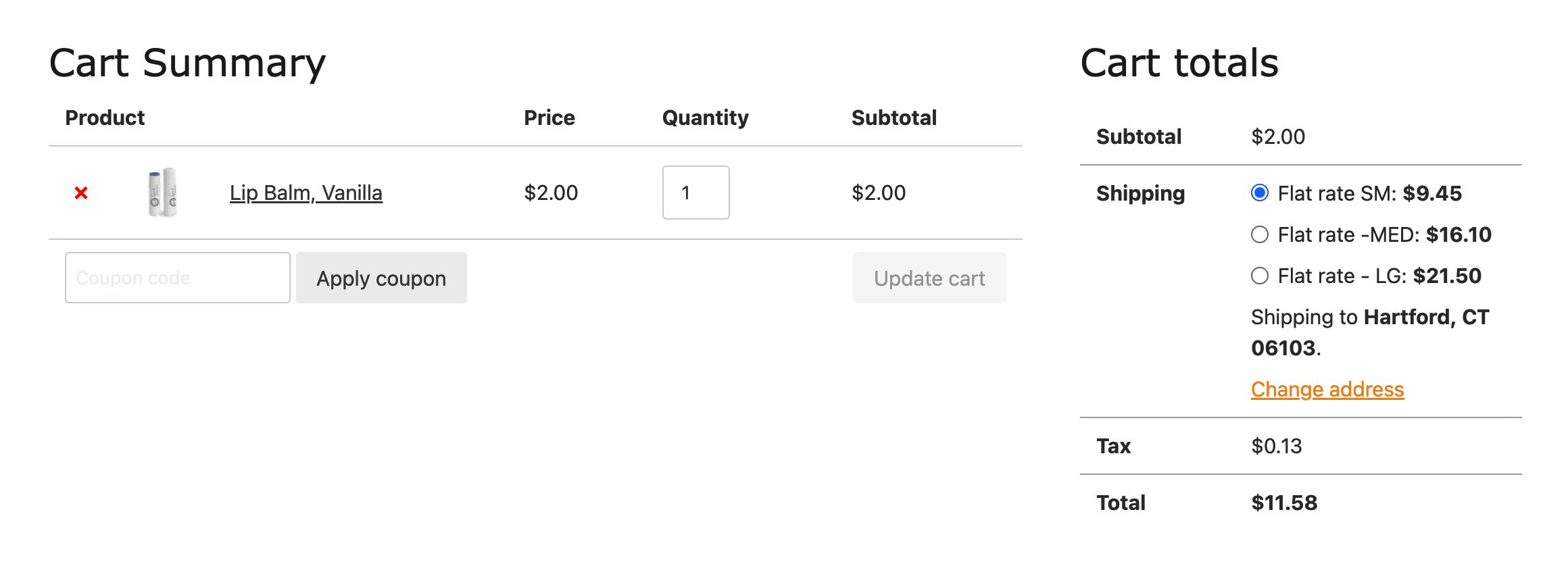

I tried out an address in Hartford, CT and it returned the 0.0635 you mentioned earlier.

Try using a private browser window and see if you get the same results. Let us know what you find out.

I see that it populated the tax for CT when billing/shipping in CT, however, when we put in an address for a different state it only shows up as .01 !! That’s inaccurate. There’s a different tax rate for all the states we ship to. What is the solution for this plug-in to select state tax according to the customer’s billing address and add properly by state based on the customer billing address? The Woo Commerce plug-in says it will calculate based on the customer billing address and gives the option to upload a CVS for all the states if you want to do it manually. When this app first started giving me trouble I uploaded a CVS of all the state taxes, and tested but it didn’t charge tax. We sell all over the US and are losing business with this. The fact that it takes days to hear back makes this even worse, what is the solution to this plug-in not working for state by state taxes when it says it will calculate for us? Is there an additional plug-in? I need this fixed now, my customer is losing business. Please help. Thanks

Let’s take a step back a minute. If you need to collect sales tax outside of the business’s home state, then WooCommerce Shipping & Tax is not the solution for the business. It can only collect for one tax “nexus.” If you want to use automated taxes with more than one nexus, you’ll need to use a tax service like TaxJar or Avalara.

* https://woocommerce.com/products/taxjar

* https://woocommerce.com/products/woocommerce-avatax/If you don’t want to do that, then the alternative is to the manual taxes. As you mentioned these can be imported with a CSV file or they can be manually added.

My recommendation would be to start out with a clean standard tax rate table and manually add in two or three tax locations/rates. Then make sure they work on the front end of the site. If they do, then add more.

If you still have trouble with the manual rates, please send over a screenshot of your standard rate table as well as one of the updated tax options without automated taxes.

Thanks

Initially I did add them all in manually and tested but they didn’t populate, perhaps there’s a setting I need to change?

I tried it including and excluding prices during the cart. It still populates the tax as .01.

Here’s a shot of the tax settings for manual-

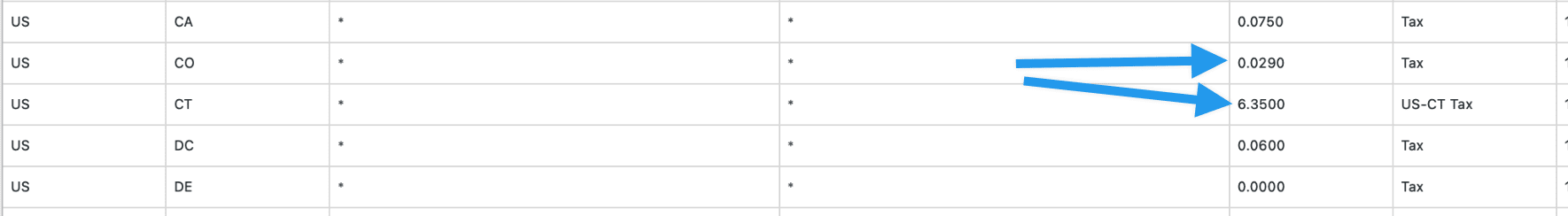

https://soe4u.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-13-at-2.42.08-PM.pngHere’s the screen shot of the tax table-

https://soe4u.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-13-at-2.19.10-PM.pngHere’s what the cart does including and excluding taxes in the cart…

https://soe4u.com/wp-content/uploads/2022/05/TaxNotPopulating2.jpgThanks for the screenshots. Part of the trouble is the actual rates in this table. If you look, the Connecticut rate is 6.3500 while the others have been converted into decimals.

Essentially it looks like all of the rates outside of the Connecticut one need to be multiplied by 100 so they are a percentage. Like the DC one is 0.06% not 6.0%.

See if changing these doesn’t get this working better for you.

Okay, I worked through revising. We uploaded a tax table chart available online. Now testing it at the cart. The other issue is the shipping, we have a ticket in on that from last week as well. Do we need a separate plug-in to populate USPS and UPS rates? We followed the guidance and loaded 3 USPS rates however it doesn’t calculate the weight right from the inventory. What are the plug-ins options that work best with this store?

To get live rates from USPS and UPS based on weight/dimensions you will need some extensions. We created these in-house and provide support for them ourselves.

* https://woocommerce.com/products/usps-shipping-method

* https://woocommerce.com/products/ups-shipping-methodAre you using these or different extensions?

We haven’t heard back from you in a while, so I’m going to mark this as resolved – we’ll be here if and/or when you are ready to continue.

- The topic ‘Taxes Don’t Populate’ is closed to new replies.